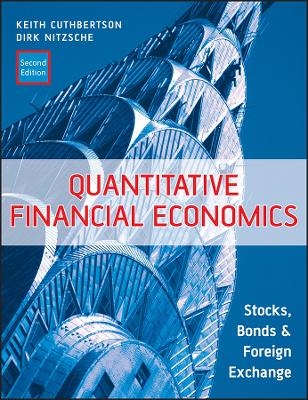

Quantitative Financial Economics

John Wiley & Sons Inc (Verlag)

978-0-470-09171-5 (ISBN)

Quantitative Financial Economics Quantitative Financial Economics provides a comprehensive introduction to models of economic behaviour in financial markets, focusing on analysis in discrete time. Following the huge success of the first edition, this second edition has been fully revised and updated to reflect new developments in theory and practice, including:

Behavioural finance: Preferences, arbitrage and learning

Mean-variance and intertemporal asset allocation

Performance of mutual and hedge funds

Momentum, value-glamour strategies, style investing, market timing.

Stochastic discount factor models: Equity premium and volatility puzzles

Affine and cash-in-advance models

Value at risk: Monte Carlo simulation, bootstrapping.

Market microstructure: FX markets, technical trading, chartism

Calibration, regime switching, data snooping, non-linear models.

The authors provide theories and tests of competing ideas in financial markets using examples from the stock, bond and foreign exchange markets. Emphasis is placed on how models inform real-world decisions, making this book accessible to both students and quants practitioners studying the behaviour of asset returns and prices.

REVIEWS FOR 1ST EDITION

Review of 1st edition in Journal of Banking and Finance (22, pp 121-124):

“In general the book is well written with a lucid exposition and Cuthbertson is eager on giving intuitive explanations whenever possible. Thus students and empirical researchers in macroeconomics and finance will undoubtedly find the book very valuable.”

Tom Engsted, Aarhus School of Business, Aarhus, Denmark

Review of 1st edition in Journal of Finance (53(1), pp. 417-420):

“I found the book accessible and informative on a variety of topics. It provided me with a different perspective on some of the recent empirical literature. I believe that many finance doctoral student and academics would find it to be a useful resource and a handy reference.”

Robert F. Whitelaw, Stern School of Business, NYU

The book has a supporting website http://www.wiley.co.uk/cuthbertson which includes questions and answers, illustrative Excel and GAUSS programmes and econometrics notes.

Keith Cuthbertson is Professor of Finance at CASS Business School, City University, London. He has been an advisor to the Bank of England and UK Treasury and a visitor at the Federal Reserve, Washington DC and Bundesbank Professor at the Freie University, Berlin. He has held chairs at the University of Newcastle and Tanaka Business School, Imperial College, as well as undertaking consultancy with financial institutions. Dirk Nitzsche is an Associate Professor in Finance at CASS Business School and previously was at the Tanaka Business School, Imperial College. Complementary texts by the same authors are Investments: Spot and Derivatives Markets, and Financial Engineering: Derivatives and Risk Management (2001) both published by John Wiley & Sons, Ltd.

Preface. Acknowledgements.

1 Basic Concepts in Finance.

Aims.

1.1 Returns on Stocks, Bonds and Real Assets.

1.2 Discounted Present Value, DPV.

1.3 Utility and Indifference Curves.

1.4 Asset Demands.

1.5 Indifference Curves and Intertemporal Utility.

1.6 Investment Decisions and Optimal Consumption.

1.7 Summary.

Appendix: Mean-Variance Model and Utility Functions.

2 Basic Statistics in Finance.

Aims.

2.1 Lognormality and Jensen’s Inequality.

2.2 Unit Roots, Random Walk and Cointegration.

2.3 Monte Carlo Simulation (MCS) and Bootstrapping.

2.4 Bayesian Learning.

2.5 Summary.

3 Efficient Markets Hypothesis.

Aims.

3.1 Overview.

3.2 Implications of the EMH.

3.3 Expectations, Martingales and Fair Game.

3.4 Testing the EMH.

3.5 Using Survey Data.

3.6 Summary.

Appendix: Cross-Equation Restrictions.

4 Are Stock Returns Predictable?

Aims.

4.1 A Century of Returns.

4.2 Simple Models.

4.3 Univariate Tests.

4.4 Multivariate Tests.

4.5 Cointegration and Error Correction Models (ECM).

4.6 Non-Linear Models.

4.7 Markov Switching Models.

4.8 Profitable Trading Strategies?

4.9 Summary.

5 Mean-Variance Portfolio Theory and the CAPM.

Aims.

5.1 An Overview.

5.2 Mean-Variance Model.

5.3 Capital Asset Pricing Model.

5.4 Beta and Systematic Risk.

5.5 Summary.

6 International Portfolio Diversification.

Aims.

6.1 Mathematics of the Mean-Variance Model.

6.2 International Diversification.

6.3 Mean-Variance Optimisation in Practice.

6.4 Summary.

Appendix I: Efficient Frontier and the CML.

Appendix II: Market Portfolio.

7 Performance Measures, CAPM and APT.

Aims.

7.1 Performance Measures.

7.2 Extensions of the CAPM.

7.3 Single Index Model.

7.4 Arbitrage Pricing Theory.

7.5 Summary.

8 Empirical Evidence: CAPM and APT.

Aims.

8.1 CAPM: Time-Series Tests.

8.2 CAPM: Cross-Section Tests.

8.3 CAPM, Multifactor Models and APT.

8.4 Summary.

Appendix: Fama–MacBeth Two-Step Procedure.

9 Applications of Linear Factor Models.

Aims.

9.1 Event Studies.

9.2 Mutual Fund Performance.

9.3 Mutual Fund ‘Stars’?

9.4 Summary.

10 Valuation Models and Asset Returns.

Aims.

10.1 The Rational Valuation Formula (RVF).

10.2 Special Cases of the RVF.

10.3 Time-Varying Expected Returns.

10.4 Summary.

11 Stock Price Volatility.

Aims.

11.1 Shiller Volatility Tests.

11.2 Volatility Tests and Stationarity.

11.3 Peso Problems and Variance Bounds Tests.

11.4 Volatility and Regression Tests.

11.5 Summary.

Appendix: LeRoy–Porter and West Tests.

12 Stock Prices: The VAR Approach.

Aims.

12.1 Linearisation of Returns and the RVF.

12.2 Empirical Results.

12.3 Persistence and Volatility.

12.4 Summary.

Appendix: Returns, Variance Decomposition and Persistence.

13 SDF Model and the C-CAPM.

Aims.

13.1 Consumption-CAPM.

13.2 C-CAPM and the ‘Standard’ CAPM.

13.3 Prices and Covariance.

13.4 Rational Valuation Formula and SDF.

13.5 Factor Models.

13.6 Summary.

Appendix: Joint Lognormality and Power Utility.

14 C-CAPM: Evidence and Extensions.

Aims.

14.1 Should Returns be Predictable in the C-CAPM?

14.2 Equity Premium Puzzle.

14.3 Testing the Euler Equations of the C-CAPM.

14.4 Extensions of the SDF Model.

14.5 Habit Formation.

14.6 Equity Premium: Further Explanations.

14.7 Summary.

Appendix: Hansen–Jagannathan Bound.

15 Intertemporal Asset Allocation: Theory.

Aims.

15.1 Two-Period Model.

15.2 Multi-Period Model.

15.3 SDF Model of Expected Returns.

15.4 Summary.

Appendix I: Envelope Condition for Consumption-Portfolio Problem.

Appendix II: Solution for Log Utility.

16 Intertemporal Asset Allocation: Empirics.

Aims.

16.1 Retirement and Stochastic Income.

16.2 Many Risky Assets.

16.3 Different Preferences.

16.4 Horizon Effects and Uncertainty.

16.5 Market Timing and Uncertainty.

16.6 Stochastic Parameters.

16.7 Robustness.

16.8 Summary.

Appendix: Parameter Uncertainty and Bayes Theorem.

17 Rational Bubbles and Learning.

Aims.

17.1 Rational Bubbles.

17.2 Tests of Rational Bubbles.

17.3 Intrinsic Bubbles.

17.4 Learning.

17.5 Summary.

18 Behavioural Finance and Anomalies.

Aims.

18.1 Key Ideas.

18.2 Beliefs and Preferences.

18.3 Survival of Noise Traders.

18.4 Anomalies.

18.5 Corporate Finance.

18.6 Summary.

19 Behavioural Models.

Aims.

19.1 Simple Model.

19.2 Optimising Model of Noise Trader Behaviour.

19.3 Shleifer–Vishny Model: Short-Termism.

19.4 Contagion.

19.5 Beliefs and Expectations.

19.6 Momentum and Newswatchers.

19.7 Style Investing.

19.8 Prospect Theory.

19.9 Summary.

Appendix I: The DeLong et al Model of Noise Traders.

Appendix II: The Shleifer–Vishny Model of Short-Termism.

20 Theories of the Term Structure.

Aims.

20.1 Prices, Yields and the RVF.

20.2 Theories of the Term Structure.

20.3 Expectations Hypothesis.

20.4 Summary.

21 The EH–From Theory to Testing.

Aims.

21.1 Alternative Representations of the EH.

21.2 VAR Approach.

21.3 Time-Varying Term Premium–VAR Methodology.

21.4 Summary.

22 Empirical Evidence on the Term Structure.

Aims.

22.1 Data and Cointegration.

22.2 Variance Bounds Tests.

22.3 Single-Equation Tests.

22.4 Expectations Hypothesis: Case Study.

22.5 Previous Studies.

22.6 Summary.

23 SDF and Affine Term Structure Models.

Aims.

23.1 SDF Model.

23.2 Single-Factor Affine Models.

23.3 Multi-Factor Affine Models.

23.4 Summary.

Appendix I: Math of SDF Model of Term Structure.

Appendix II: Single-Factor Affine Models.

24 The Foreign Exchange Market.

Aims.

24.1 Exchange Rate Regimes.

24.2 PPP and LOOP.

24.3 Covered-Interest Parity, CIP.

24.4 Uncovered Interest Parity, UIP.

24.5 Forward Rate Unbiasedness, FRU.

24.6 Real Interest Rate Parity.

24.7 Summary.

Appendix: PPP and the Wage–Price Spiral.

25 Testing CIP, UIP and FRU.

Aims.

25.1 Covered Interest Arbitrage.

25.2 Uncovered Interest Parity.

25.3 Forward Rate Unbiasedness, FRU.

25.4 Testing FRU: VAR Methodology.

25.5 Peso Problems and Learning.

25.6 Summary.

26 Modelling the FX Risk Premium.

Aims.

26.1 Implications of β < 1 in FRU Regressions.

26.2 Consumption-CAPM.

26.3 Affine Models of FX Returns.

26.4 FRU and Cash-in-Advance Models.

26.5 Summary.

27 Exchange Rate and Fundamentals.

Aims.

27.1 Monetary Models.

27.2 Testing the Models.

27.3 New Open-Economy Macroeconomics.

27.4 Summary.

28 Market Risk.

Aims.

28.1 Measuring VaR.

28.2 Mapping Assets: Simplifications.

28.3 Non-Parametric Measures.

28.4 Monte Carlo Simulation.

28.5 Alternative Methods.

28.6 Summary.

Appendix I: Monte Carlo Analysis and VaR.

Appendix II: Single Index Model (SIM).

29 Volatility and Market Microstructure.

Aims.

29.1 Volatility.

29.2 What Influences Volatility?

29.3 Multivariate GARCH.

29.4 Market Microstructure–FX Trading.

29.5 Survey Data and Expectations.

29.6 Technical Trading Rules.

29.7 Summary.

References.

Recommended Reading.

Index.

| Erscheint lt. Verlag | 27.12.2004 |

|---|---|

| Reihe/Serie | Financial Economics and Quantitative Analysis Series |

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 188 x 244 mm |

| Gewicht | 1383 g |

| Themenwelt | Wirtschaft ► Volkswirtschaftslehre |

| ISBN-10 | 0-470-09171-1 / 0470091711 |

| ISBN-13 | 978-0-470-09171-5 / 9780470091715 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich