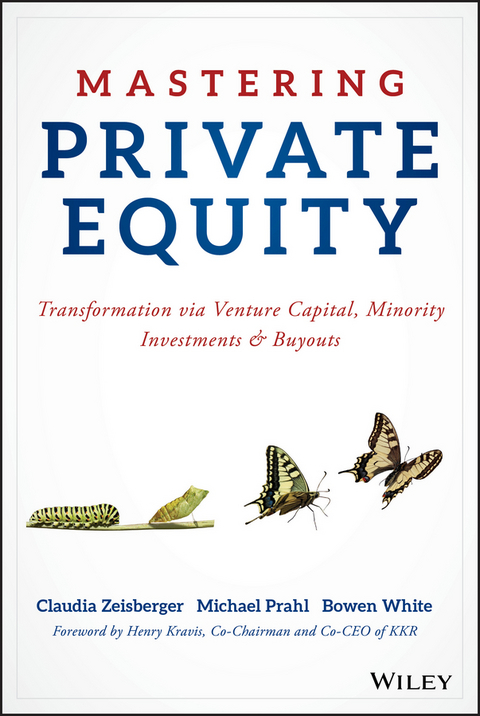

Mastering Private Equity (eBook)

368 Seiten

Wiley (Verlag)

978-1-119-32794-3 (ISBN)

Claudia Zeisberger is an INSEAD Senior Affiliate Professor of Decision Sciences and Entrepreneurship and Family Enterprise. She is concurrently the Academic Director of INSEAD's Global Private Equity Initiative (GPEI), one of INSEAD's centers of excellence, which she founded in 2008 to focus the school's capabilities & achievements in Private Equity, increase its visibility and cater to specific industry needs in research and education. At INSEAD, she teaches in the MBA and EMBA programmes as well as in multiple Executive Education courses both in Singapore & in Fontainebleau. Michael Prahl is Adjunct Professor for Entrepreneurship & Family Enterprise at INSEAD, he is also Executive Director GPEI, oversees all research of the initiative and was instrumental in creating all its recent publications, its database project and outreach activities. His specific research interests are in the areas of risk and return in emerging markets, operational value creation and market entry strategies & portfolio allocation for limited partners. Bowen White is a Research Associate at GPEI. Bowen's research interests include private equity in emerging markets, the institutionalization of SE Asian financial markets, and project finance. Prior to moving to Singapore in 2009, Bowen spent five years in the New York hedge fund industry in trading and business development roles.

List of Contributors vii

Foreword by Henry R. Kravis, Co-Chairman and Co-CEO of KKR ix

Preface xiii

How to Use This Book xvii

Section I Private Equity Overview 1

Chapter 1 Private Equity Essentials 5

Chapter 2 Venture Capital 19

Chapter 3 Growth Equity 33

Chapter 4 Buyouts 43

Chapter 5 Alternative Strategies 57

Section II Doing Deals in PE 69

Chapter 6 Deal Sourcing & Due Diligence 73

Chapter 7 Target Valuation 87

Chapter 8 Deal Pricing Dynamics 97

Chapter 9 Deal Structuring 109

Chapter 10 Transaction Documentation 121

Section III Managing PE Investments 133

Chapter 11 Corporate Governance 137

Chapter 12 Securing Management Teams 149

Chapter 13 Operational Value Creation 161

Chapter 14 Responsible Investment 173

Chapter 15 Exit 185

Section IV Fund Management and the GP-LP Relationship 197

Chapter 16 Fund Formation 201

Chapter 17 Fundraising 215

Chapter 18 LP Portfolio Management 227

Chapter 19 Performance Reporting 241

Chapter 20 Winding Down a Fund 253

Section V The Evolution of PE 263

Chapter 21 LP Direct Investment 267

Chapter 22 Listed Private Equity 279

Chapter 23 Risk Management 289

Chapter 24 Private Equity Secondaries 301

Chapter 25 Evolution of Private Equity 313

Acknowledgments 325

About the Authors 327

Glossary 329

Index 341

| Erscheint lt. Verlag | 6.6.2017 |

|---|---|

| Sprache | englisch |

| Themenwelt | Recht / Steuern ► Wirtschaftsrecht |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Schlagworte | Finance & Investments • Finanz- u. Anlagewesen • Finanzwesen • Private Equity |

| ISBN-10 | 1-119-32794-6 / 1119327946 |

| ISBN-13 | 978-1-119-32794-3 / 9781119327943 |

| Haben Sie eine Frage zum Produkt? |

Größe: 46,9 MB

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich